Just in time for the Spring 2020 real estate market, Canada's finance minister has announced changes to the stress test used to qualify insured and insurable mortgages. The government originally introduced a minimum qualifying rate in 2016 to ensure that home buyers would be able to afford their homes even if interest rates rise, incomes change, or families are faced with unforeseen expenses.

How is the mortgage stress test changing?

The changes to the benchmark rate will unlink it from the posted rates set by the major banks, and instead take into account actual mortgage rates offered by lenders on a weekly basis. It will be calculated as the median 5-year fixed insured mortgage rate (per the Bank of Canada), plus a 2% buffer. This means the benchmark will be more dynamic and responsive to market conditions. The Minister of Finance will also have the authority to adjust the buffer in the future.

The minimum qualifying rate for insured mortgages will then be the greater of:

- Your contract rate, which is the mortgage interest rate offered by the lender and agreed to by you; or

- The new Benchmark Rate.

Who is affected?

At this point, the changes to the mortgage qualifying rate only apply to insured and insurable mortgages, which are regulated by the federal government. That means you fit into the established guidelines, including:

- A down payment between 5% - 20% of the home's purchase price

- Purchasing a home less than $1,000,000

- A mortgage amortization of 25 years

Uninsurable (conventional) mortgages are regulated by the Office of the Superintendent of Financial Institutions (OSFI). Similar changes to the uninsurable mortgage qualifying rates are being considered and will be announced by April 1, 2020.

What does the change mean in practical terms?

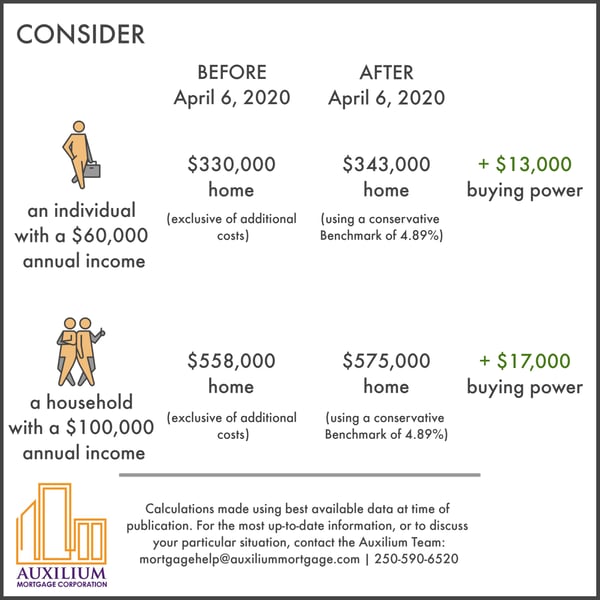

In the short term, many folks will find their purchasing power increased. Let's look at some typical Victoria home buyers.

Effectively, the increase in what you are able to afford could be the difference between buying a townhouse instead of a condo or a property with a suite instead of without one.

When will the change happen?

The change will take effect as of April 6, 2020.

What should I do next?

If you've been saving to buy a home, keep on doing what you're doing! Additional money towards your down payment will only help you. If you were planning on making your purchase this year, you can get in touch with our team to start the pre-qualification process. We'll be able to review your mortgage options with you, and then you can decide whether the time is right now or once the changes to the stress test come into effect.

The Auxilium team is up-to-date on all of the latest industry changes in order to provide the best service for our clients. If you want to discuss your particular situation, give us a call at 250-590-6520 (toll-free 1-855-590-6520) for a free consultation. Walk-ins are welcome at our 307 Goldstream Avenue location during regular business hours, and we can arrange an appointment evenings or weekends to work with you.

Auxilium Mortgage Corporation is based in Victoria, BC and works with clients locally and across Canada. The Auxilium team has over 100 years of combined financial experience and access to dozens of lenders to help you meet your goals.