Debt consolidation is an effective tool to help pay down some of that accumulated debt and get some improved cash flow, getting you out of that cash flow crunch!

If bills are a problem, your home may be the key to your freedom from debt. If you're currently paying off several credit cards, lines of credit or even a car loan, you can use a mortgage for debt consolidation to lower your payments. Not only does this mean that you'll only have one, lower interest bill to worry about, but this type of loan is available easily and almost instantly!

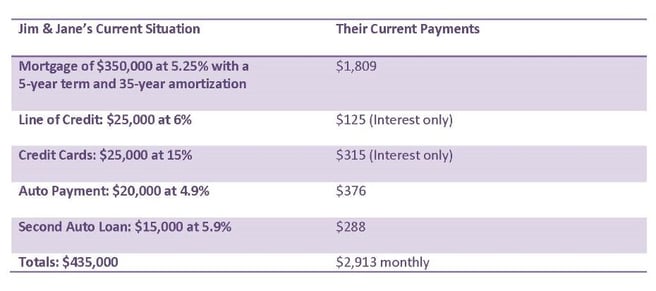

Still debating if this is what you're looking for? Read Jim and Jane's story below to find out their situation and what ways debt consolidation could help them.

What Jim and Jane could be paying:

Imagine you’re John and Jane for a moment and picture a new mortgage with an interest rate of 3.39% on $435,000 with a 25-year amortization. This would make monthly payments $2,146.00. That’s $767 per month of improved cash flow, plus your mortgage is paid off 10 years sooner.

Now for the real kicker… imagine a new mortgage with an interest rate of 3.39% on $435,000 with a 16 year amortization. You would have a monthly payment of $2,933. Essentially your payments are $20.00 more, but your mortgage has dropped by 19 years, and all of your debts are now paid in full! That’s $50,000 in credit card and credit line debt that you were never going to be able to pay off, because all you could afford to pay was interest. Now it’s gone!

Isn’t it amazing that these loans can save you years of payments and thousands of dollars? Are you ready to take years off your mortgage while saving thousands of dollars? Click here to begin!

Examples are all based on OAC (On Approved Credit), and subject to change and availability.