The Canadian Mortgage and Housing Corporation (CMHC) has announced 3 major changes to the way that mortgage applications for insured & insurable files will be assessed. If you are planning to buy a home with less than 20% of the purchase price as a down payment, these qualifying rules will affect you.

Minimum Credit Score

What CMHC announced: "Establish minimum credit score of 680 for at least one borrower"

What this means for you: At least one person in your household who will be on title for the home purchase and mortgage application must have a credit score of at least 680. There are many free services you can use to check your own credit score; however, they may not always take into account the same factors that a mortgage lender will consider.

Best practices to meet the minimum credit score requirement include:

- Making all payments on time;

- Keeping use ratios low – around 30% of your available credit is a good guideline;

- Only opening credit lines when/as you need them.

Current Debt

What CMHC announced: "Limiting the Gross/Total Debt Servicing (GDS/TDS) ratios to our standard requirements of 35/42"

What this means for you: Your Gross Debt Servicing (GDS) includes costs related to housing (mortgage, property tax, heat, etc) as a percent of your income; your Total Debt Servicing (TDS) adds any other debt obligations you may have.

This change will lower the percent of your income that will be accepted towards your current debt. The impact will be a reduction in buying power.

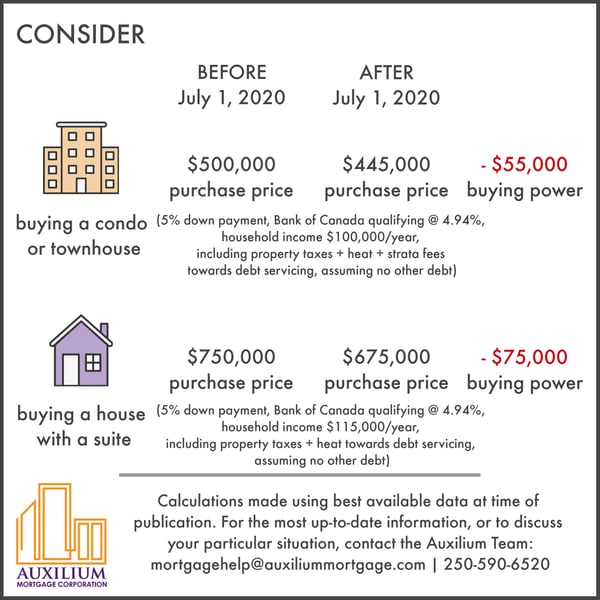

For example, if you are considering buying a condo or townhouse: before July 1, 2020 with a household income of $100,000 you would be able to afford a purchase price of $500,000. With the new qualifying ratios, you would be able to afford a purchase price of only $445,000 – a reduction of $55,000.*

If you are considering buying a home with a suite that you will rent out: before July 1, 2020 with a household income of $115,000 you would be able to afford a purchase price of $750,000. With the new qualifying ratios, you would be able to afford a purchase price of only $675,000 – a reduction of $75,000.*

Down Payment

What CMHC announced: "Non-traditional sources of down payment that increase indebtedness will no longer be treated as equity for insurance purposes"

What this means for you: If you do not have 5% of the purchase price saved for the down payment on the property you wish to buy, you will not be able to borrow or otherwise finance the portion of the down payment you are missing.

Home buyers who are using their own savings, whether in a bank account, investments, or using the Home Buyers Plan that lets you borrow from your own RRSP, are considered traditional sources and will still be eligible for an insured or insurable mortgage.

Preserve Your Buying Power

If you've been holding off on buying a home but believe you're ready to purchase, a mortgage pre-approval will not be enough to grandfather your file under the current guidelines. The only way to preserve your overall buying power is to have a "real deal" in the system before June 30, 2020. This means that you have an accepted offer on a property and your file has been submitted to a lender, who has in turn submitted it to CMHC.

The Auxilium Team keeps track of key developments relating to home ownership in order to provide you with the best possible solution for your situation. If you're ready to buy a home and want to preserve your buying power, contact us for a free consultation with one of our mortgage specialists: call 250-590-6520 (toll-free 1-855-590-6520) to get started today. We can arrange a phone, video conference, or in-person appointment to work with you.

* The calculations in this post have been made using the best available data at the time of publication (5% down payment, Bank of Canada qualifying @ 4.94%, including property taxes + heat + strata fees towards debt servicing, assuming no other debt). For the most up-to-date information, or to discuss your particular situation, contact the Auxilium Team.

Auxilium Mortgage Corporation is based in Victoria, BC and works with clients locally and across Canada. The Auxilium team has over 100 years of combined financial experience and access to dozens of lenders to help you meet your goals.