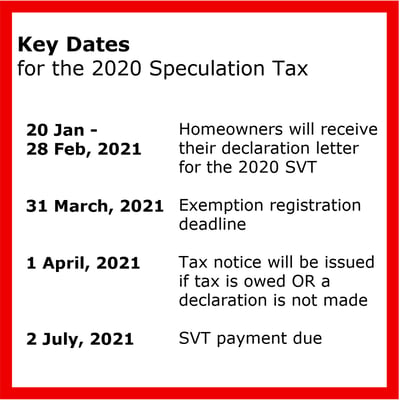

The Speculation and Vacancy Tax (SVT) was introduced by the B.C. government in 2018 as part of the plan to address affordable housing. Property owners must make a declaration by March 31, 2021 for their 2020 tax status.

All residential property owners in the designated regions will be required to complete an annual declaration for the tax.

All residential property owners in the designated regions will be required to complete an annual declaration for the tax.

- Capital Regional District, excluding Salt Spring Island, Juan de Fuca Electoral Area, Southern Gulf Islands

- Metro Vancouver Regional District, excluding Bowen Island, the Village of Lions Bay, Electoral Area A

- Abbotsford

- Mission

- Chilliwack

- Kelowna

- West Kelowna

- Nanaimo

- Lantzville

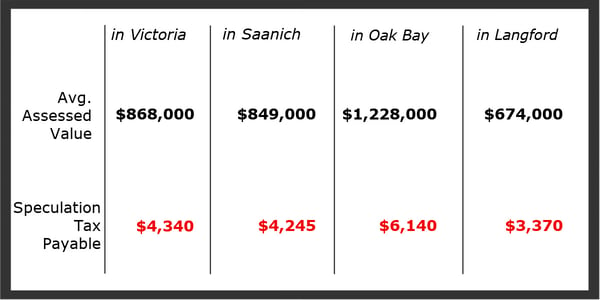

The SVT will apply based on the ownership of the property as of December 31 each year. The tax rate for 2020 is 2% of your property's assessed value for foreign owners and satellite families; 0.5% of your property's assessed value for Canadian citizens or permanent residents of Canada who are not members of a satellite family.

The government expects 99% of British Columbians to be exempt from the SVT

Your declaration letter will contain two unique identification numbers: a declaration code and a letter ID. You will need both of these numbers, along with your SIN to verify your identity and register an exemption. You will be able to claim your exemption either online or by phone.

All owners of a property must complete their own declaration, even if they are spouses or common law partners.

Exemptions include:

- The property is your principal residence

- The property is occupied by a tenant for at least 6 months of the year

- The property is under construction or undergoing extensive renovations

- The residence is uninhabitable

- The property was bought or inherited in the taxable year

- You and your partner have separated during the taxable year

- You have been out of your home for medical treatment during the taxable year

- The property has rental restrictions (only valid in 2018 & 2019 years)

- The property includes a licenced child daycare

- There is no residence on the property

See the full list of exemptions on the Government of B.C. website.

What does this mean locally?

If you're still unsure of what the Speculation and Vacancy Tax means for you, give our team a call at 250-590-6520. We keep track of key developments relating to home ownership in order to provide you with the best possible solution for your situation.

Auxilium Mortgage Corporation is based in Victoria, BC and works with clients locally and across Canada. The Auxilium team has over 100 years of combined financial experience and access to dozens of lenders to help you meet your goals.

This post reflects the best available information at the time of writing/last update. In order to ensure that you have the most up-to-date information, contact us to confirm the details for your specific situation.

Originally posted January 2019

Updated January 2020

Updated January 2021